Equity, Gold & Bitcoin – A match made in Heaven?

Many investors are concerned about incorporating crypto exposure into their portfolios given the extreme volatility and returns in comparison to traditional asset classes. In this paper we would like to shed some light on the effects of adding Bitcoin to traditional asset classes like Equities and Gold in a passive portfolio.

However, it should be noted that the focus is on understanding the different return dynamics of each asset and the combination of it. We are not discussing any portfolio optimization as it depends on the portfolio objectives and these differ for every individual use case.

Conclusion

We can conclude that adding Bitcoin to a portfolio of traditional assets (Gold and Equity) seems to improve the risk compensation for the given observation window. However, the overall risks of such a portfolio are still dominated by Bitcoin. Therefor we introduce the concept of de-leveraged Bitcoin.

By combining de-leveraged Bitcoin with Equity and Gold into an equally weighted portfolio, we can observe an increase in risk compensation (Sharpe Ratio) without incurring much higher risks in terms of volatility and drawdowns. However, even de-leveraged Bitcoin shows still rather high drawdowns. This can be an issue when enduring large losses within the individual portfolio constituents.

In addition, the negative portfolio impact of Bitcoin could be even higher if correlations during market downturns increase. Therefore, we would suggest to (1.) generally establish a portfolio with more constituents to benefit from diversification and (2.) incorporate a tactical asset allocation, which controls volatility within each portfolio constituent. We will discuss these options in one of our next publications.

“Diversification and globalization are the keys to the future.”

Fujio Mitarai

Bitcoin vs. Traditional Assets

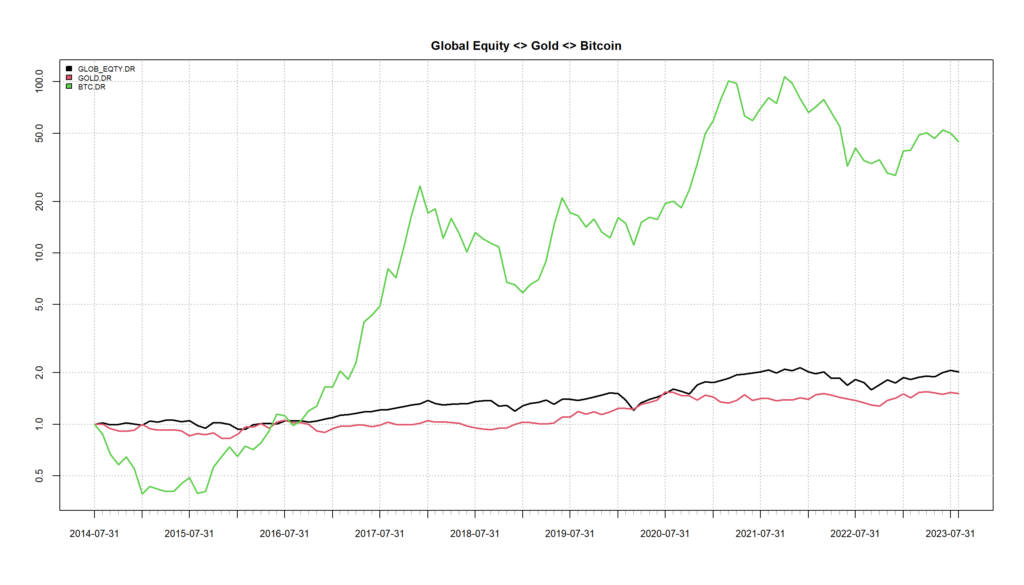

Performance

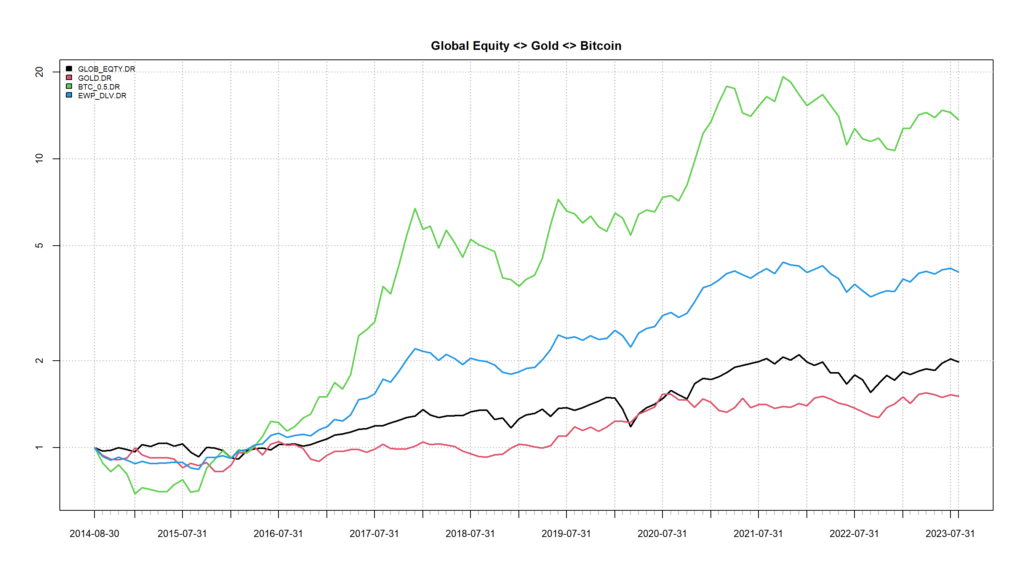

As it can be observed immediately, Bitcoin outperforms by “far and large” the two traditional assets but also shows extreme fluctuations, which from an investor perspective are difficult to manage.

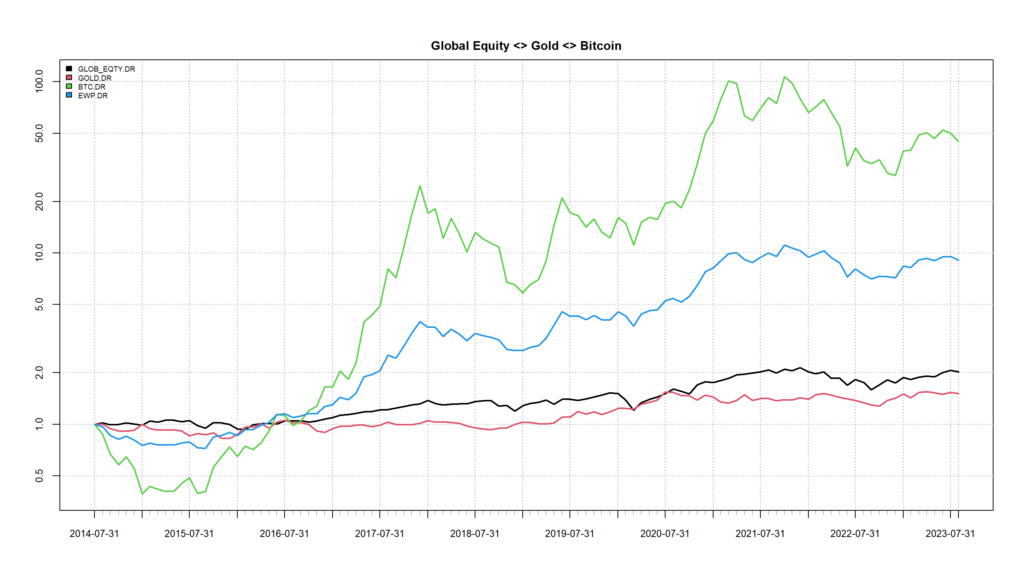

In order to understand the potential impacts of adding bitcoin to a portfolio, we introduce an equally weighted portfolio (EWP), often referred to as naive portfolio. However, it is a reasonable starting point for an analysis as (1.) it avoids introducing any weighting assumptions and (2.) in the feasible set of all possible combinations, it represents the point with the highest diversification.

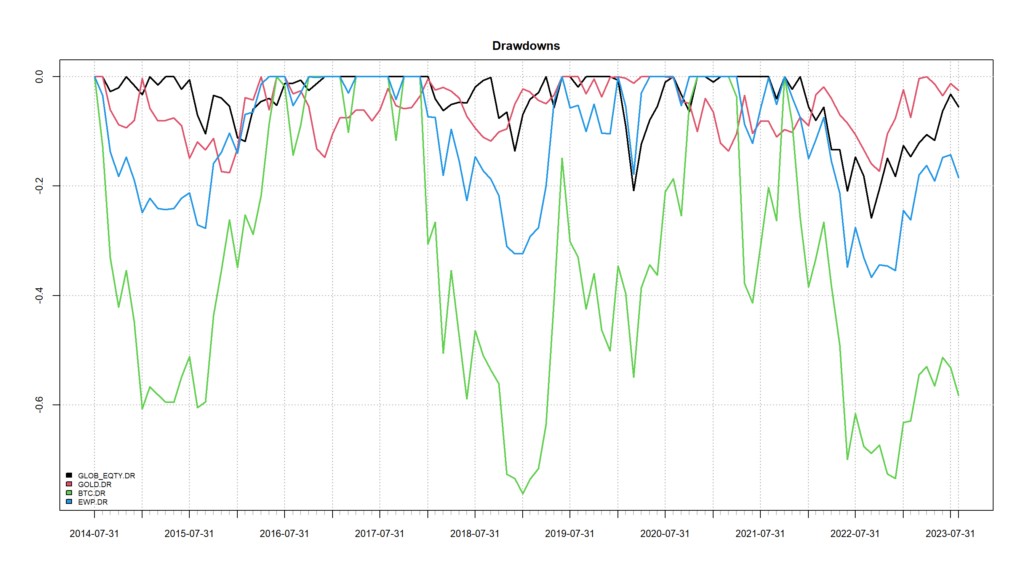

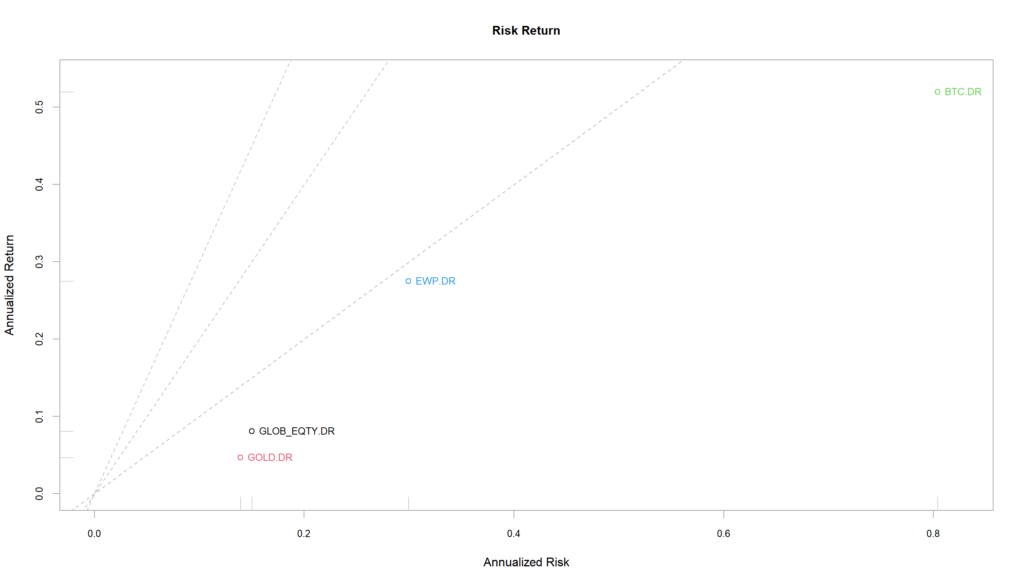

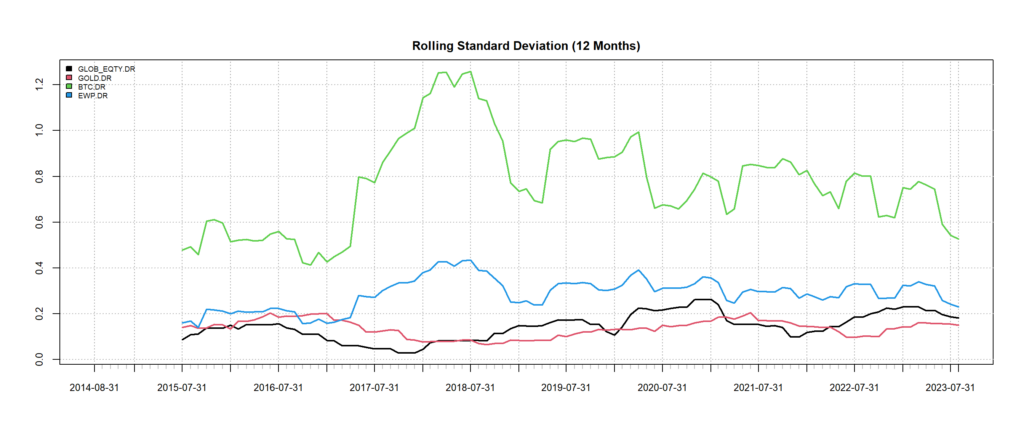

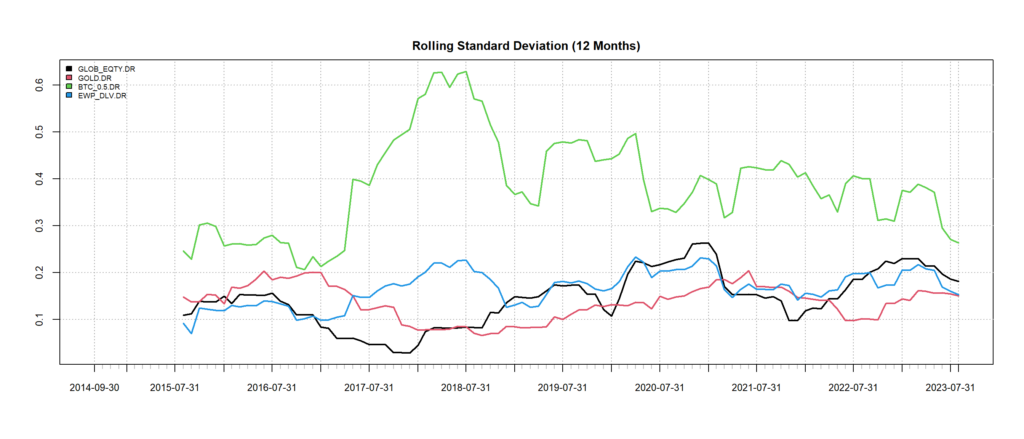

Risk

The drawdown distributions show the long phases where Bitcoin drawdowns surpass significantly those of Equity and Gold. The EWP – as expected – is positioned between Bitcoin and the other assets. The drawdowns are reduced but with -36.5% still on the higher side. Given the asymmetry of losses and required recovery returns, as a rule of thumb, the drawdowns of the portfolio should not exceed -20%.

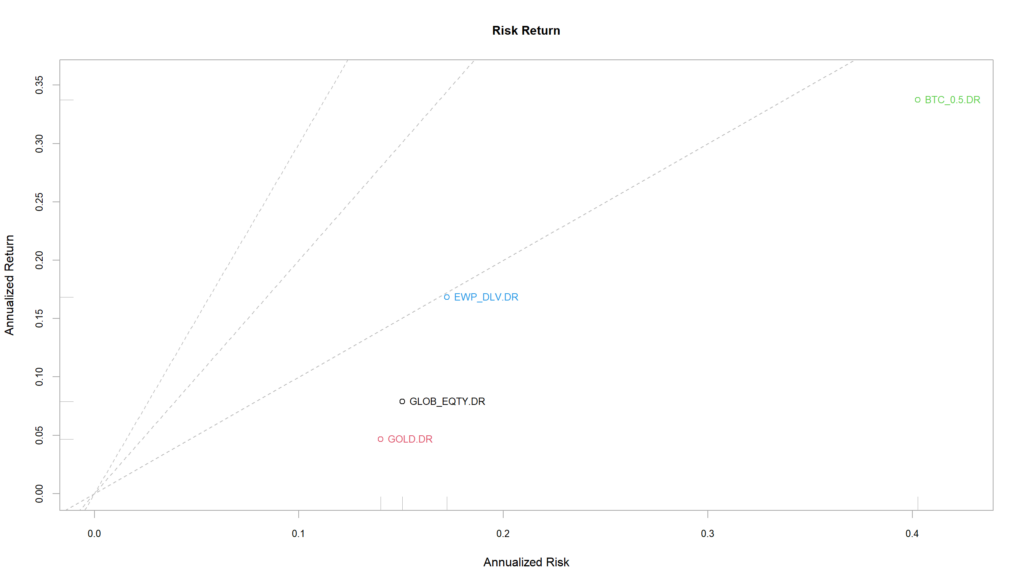

From a risk/return perspective, the EWP is positioned approx. in between Bitcoin and Equities, Gold.

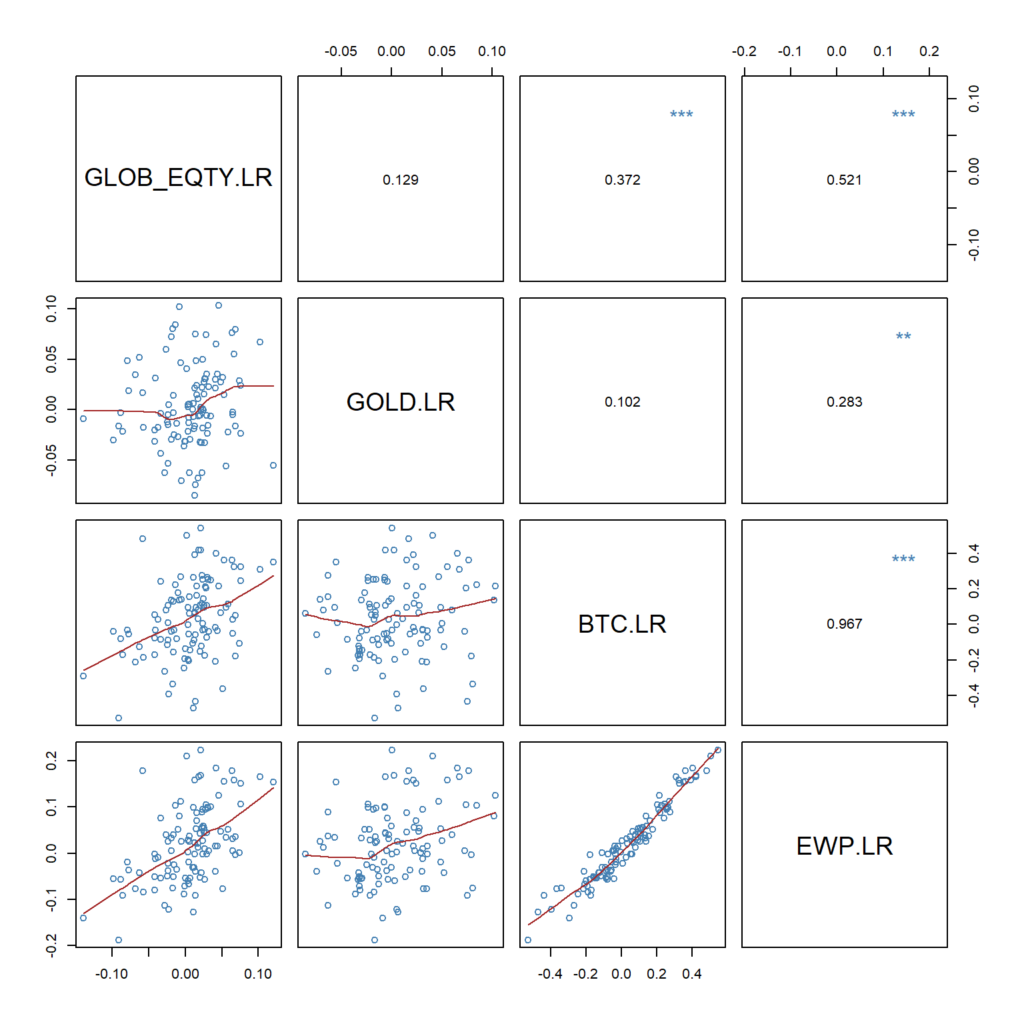

On the side of risk compensation, Bitcoin’s Sharpe Ratio is higher than those of the other assets. The maybe surprising observation is that the Sharpe Ratio of the EWP is higher than Bitcoin. The rationale for this effect is the low correlation between the three assets, which reduces volatility in the portfolio context.

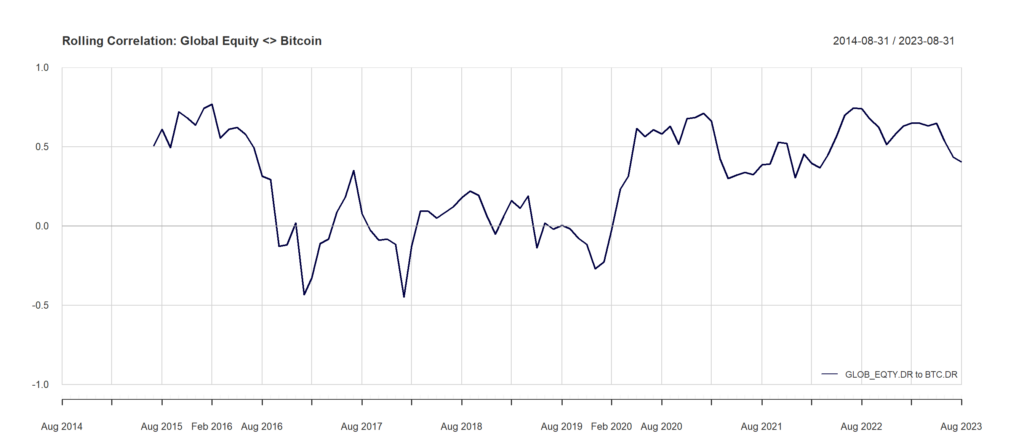

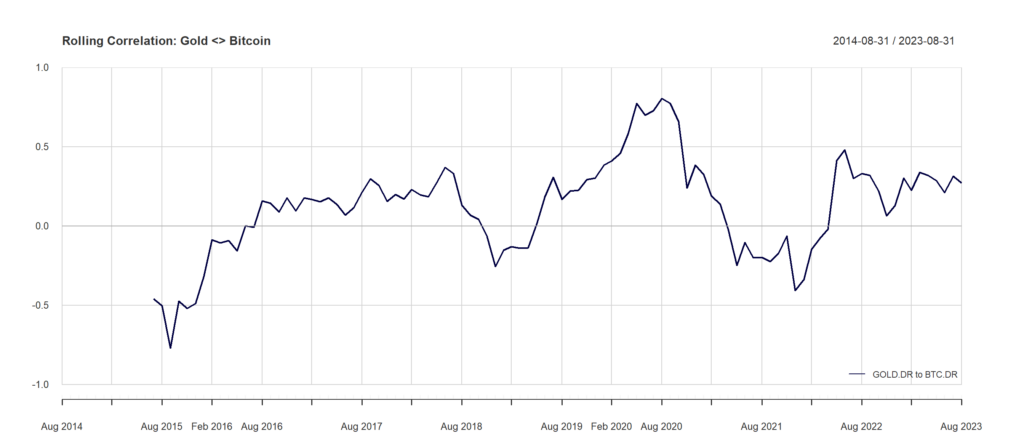

Correlation Analysis

Rolling Correlation

An important aspect of correlation is that it changes over time. So in addition to the average correlation (as shown in the matrix above), rolling correlation shows that it increases very often during market crises e.g. 2020.

Results Discussion

The differences between Bitcoin and both traditional assets with regard to risk/return are not necessarily surprising. However, the benefit of adding Bitcoin to the portfolio can be appreciated when looking at the equally weighted portfolio (EWP). Returns of the EWP are still high but – even more important – the Sharpe Ratio also increases significantly over Bitcoin. What is not necessarily optimal are the drawdowns of the EWP, which are still too high. One simple approach to reduce these drawdowns would be to de-leverage the Bitcoin exposure, which we will analyze in the next chapter.

Deleveraged Bitcoin vs. Traditional Assets

We now introduce the concept of de-leveraging, by replacing 100% Bitcoin as EWP constituent by a combination of 50% Bitcoin and 50% Cash (BTC_0.5). The idea behind it is to reduce the volatility of Bitcoin exposure to the extent that it does not overrides the dynamics of the other assets. This results in the de-leveraged EWP: the EWP_DLV. We can observe a similar performance relationship between the assets than before but now on a much lower scale.

Performance

Risk

The drawdowns of de-leveraged Bitcoin are still significant, but the de-leveraged EWP is now in a similar range as Equity and Gold.

Standard Deviation

Author: Felix Fernandez

Felix Fernandez holds a diploma in Electronics & Information Technology from the University of Applied Sciences in Frankfurt with a specialization in software simulation environments. He has a long track-record of more than 20 years in the financial industry and different management roles within Deutsche Börse AG/Eurex. After an intensive engagement with the ETH/Rmetrics Association, Felix assumed November 2016 the role as CEO of Adaptivv Financial Technologies AG.

About Adaptivv Financial Technologies

Adaptivv Financial Technologies AG was created in 2016 as a spin-off from the Swiss Federal Institute of Technology Zurich (ETH) and is now considered an established and competent partner when it comes to Drawdown Management. Since 2016 we successfully use the Bayesian Change Point method to identify regime changes in the traditional as well as in the digital market.

The Adaptivv Sensor has been developed at ETH Zurich over a period of more than 10 years. The Adaptivv Sensor measures the stability of the market real-time and provides a clear, actionable output to adapt to current market conditions and risks. As a result, we can protect your portfolio from severe drawdowns and increase risk-adjusted returns. Since 2016 Private Banks, Family Offices and Swiss Pension Funds trust our technology.

Disclaimer

This paper contains theoretical use-cases, which are intended for finance professionals. While the publisher and the authors have used their best efforts in preparing this publication, they make no representations or warranties with respect to the accuracy or completeness of the contents of this publication and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials.

Even though some instruments show more or less favorable properties, no explicit investment advice is made nor suggested. The assessment contained herein may not be suitable for your situation. You should consult with an investment professional where appropriate. Neither the publisher nor authors shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages based on this publication.

Copyright 2023, Adaptivv Financial Technologies AG, Zurich. The copying and/or public distribution of contents of this analysis is only permitted by way of written authorization by the publisher.